Discussion Seminar 0: Understanding the Tech

Overview: The purpose of this assignment

is to make sure that you know how to access the tech in this

class.

Instructions: Answer the following and upload your

results as a pdf into Gradescope (check your email for

an invite to Gradescope). Include the questions on your

document

1.) General Questions: Name (and what

you want to be called), major, and how many quarters have you

attended

Highline

2.) Life questions: Are you and your family safe and stable economically? How are you feeling

about America? How hopeful are you for your academic and

professional future?

3.) Class/school: What are you most and

least excited about this quarter? What (if anything) may I do as your instructor to

support you at this time?

4.) Accessing the

apps/web used in this class

a.) Canvas: What is the class image?

b.)

MyLabs: How many questions are in

assignment, "1.1: Systems of Linear Equations"

c.) Dusty's Webpage:

- What color highlighter did I use on the

completed workalong for 1.1

as posted on the class website?

- How many completed workalongs are linked on the class website?

- How many minutes long is the 1.1 video?

d.) YouTube: Dusty is not (yet) a famous YouTuber.

Which of the video on his channel has the most views?

(Like, comment, and subscribe!)

e.) Slack: There are four channels we will use on Slack.

- General: This is where I will make announcements and you

should ask general questions about the class (i.e., What

sections are on the Assessment?)

- Homework: This is where you will

post questions and answers to homework questions.

- Study groups: This is where you can post about upcoming study

groups.

- Random: You can post about club meetings, off campus

gatherings, and fun stuff.

- In "Study groups" post an

audio clip of you pronouncing your name and what you would like

to be called. Alternately, if you are feeling

cool and are using Slack on a desktop, add an audio clip and

pronunciation to your Slack profile.

f.)

Gradescope: Upload your responses as a pdf into

Gradescope under assignment "Discussion Seminar 0"

5.) Watch this clip on "How

to watch math videos." What are Trefor's seven

suggestions? What is one thing that you learned and would

like to apply through this video?

Discussion

Seminar I: Letters from Previous Students

Overview: The purpose of this assignment

is to help you get the most from this class by having you

reflect upon what former students have shared.

Instructions: Please read

some

letters from

past students. Use your observations of the letters

and reflections upon your own skills and ablities as a

mathematician to answer the following. Include the

questions on your document and bring a physical (paper) copy to

class.

0.) What is your name? In general,

do you like to hear your name spoken? (Dale Carnegie said:

"Remember that a person's name is to that person, the sweetest

and most important sound in any language.")

1.) Please read

some letters from my

former students.

2.) Why did you choose these particular

letters? What is one similarily you have

with these students ... one difference

3.) What are two

habits they indicate will help you be successful?

4.) What

are two questions/concerns that the letters address?

5.)

Having read the letters, you now have a sense for how this class

may foster broader studenting and math skills. What skills and

abilities would you like to develop this quarter?

Discussion Seminar III:

Thoughts on Buying Cars

Overview: Where there are cars, there are

always stories. So let's talk about cars. Most

students want to buy a vehicle and some know lots more about

this than me. I'm not an expert, but I have owned over a

dozen vehicles (no loans). Our first one burned oil ... so

much so that we had to add a quarter every 100 miles! But

it kept running and got us to the next vehicle.

Instructions: Watch and learn Dave's

thoughts on the financial side of buying a car. Here are a

few videos; pick what is helpful to you.

Finding a

Cheap Car,

Buy

Without Debt,

Leasing

vs. Buying,

New vs.

Used Cars, or find one(s) of your choice on YouTube.

0.) What is your name (first and last)?

Do you have a story about a famous relative/ancestor?

1.)

What are a few things you learned from Dave in the videos?

2.) Dave says not to buy a brand new car unless you have a

million dollars saved up. Wow, that is a lot! Do you

agree? If not, how much do you think you should have saved

up before buying a brand new car?

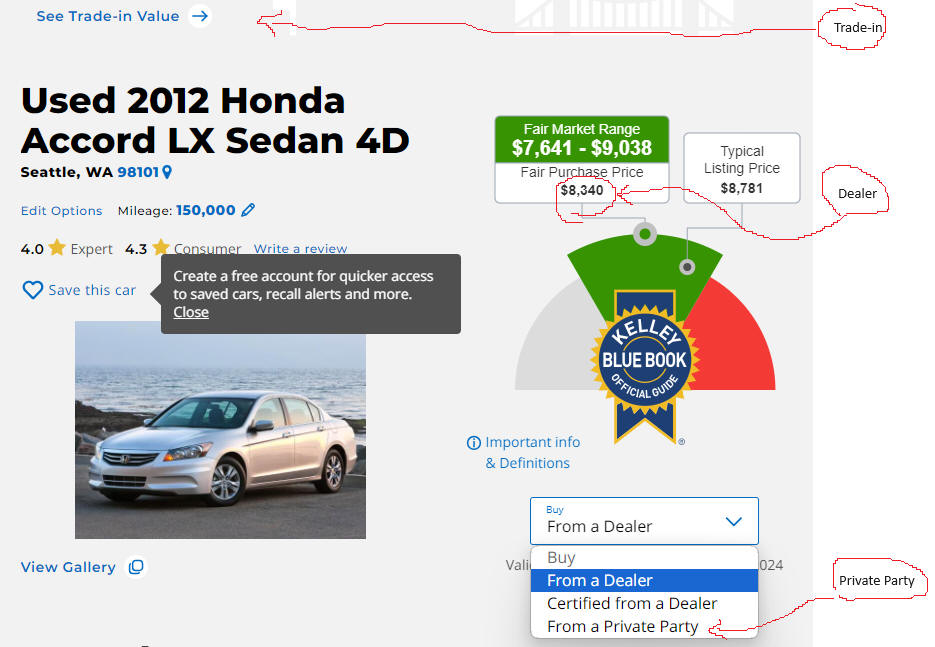

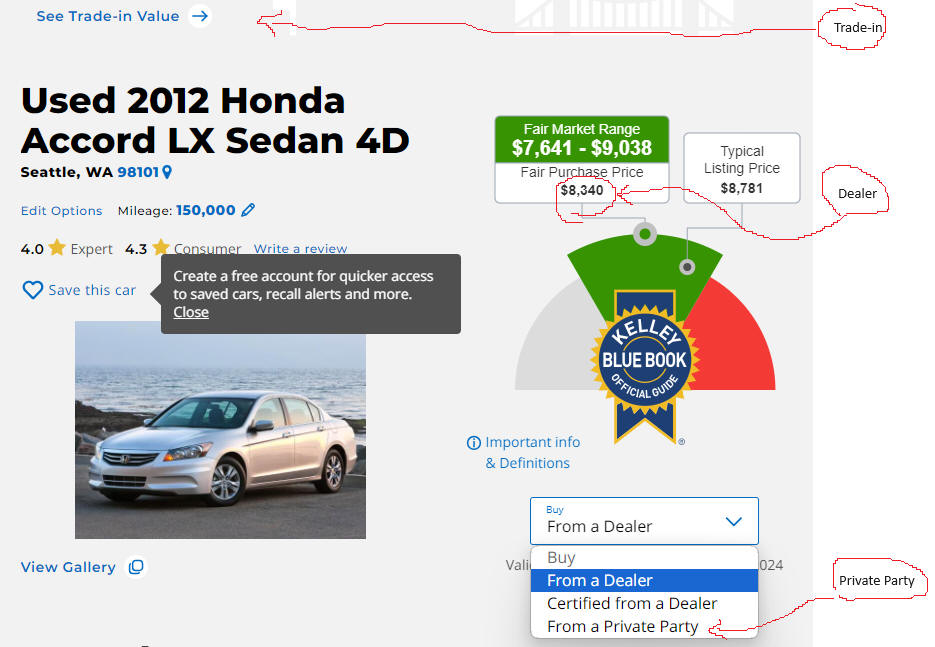

3.) Exploring Kelley Blue Book.

This website is the standard if you want to know what a car is

worth. What is the Fair Market Range of a used 2012 Toyota

Camry LE Sedan with 150,000 miles? How much is it if you

buy it at a dealership vs. from a private party vs. trade-in?

(Note: Feel free to adjust the year/make/model/mileage to fit

your interests).

4.) What are the pros and cons of buying a

car at a dealership? What are the pros and cons of buying

from a private party?

5.) The State of Washington believes

that it costs about $0.67 to drive a vehicle for one mile

(mileage reimbursement). What is covered in this cost?

6.) Thinking about the previous question, do you think it is

more cost effective to drive a cheap car that needs repairs or a

more expensive car that always runs? Why?

7.) Share

your wisdom: Dave Ramsey says not to buy a new car unless you

have a million bucks in the bank. My Dad said that a car

should drive 10 miles for every dollar you spend. What

rule of thumb do you have for when/how to buy a car?

Discussion Seminar IV: Credit Cards

Overview: A coworker had a masters

degree, but had never learned about credit cards. He got

himself into a bunch of trouble. I myself am a reluctant

credit card user. My wife and I pay our balance in full,

but we spend more with cards than if we used cash. I'm not

proud of using cards, but it is true. I want to protect

you from the issues that my friend had and perhaps even get you

to do better than me!

Instructions: Watch some of Dave's rants about credit cards (he

is super opinionated on this). Here are a few videos; pick

what is helpful to you:

Get rid of

cards?,

Why can't

I use credit cards if I pay them off every month?, and

getting out of debt with

The

Debt Snowball.

Then answer the discussion questions below in writing. Include

the questions on your document and bring a physical (paper) copy

to class.

0.) What is your name? Do you have

a nickname? (Other than my nickname Dusty, I was also

called Chewie and Encyclopedia)

1.) What is the difference

between a credit and a debit card?

2.) What experience do you

(or your family) have with credit cards

3.)

If the balance isn't paid in full, credit cards are a form of

loan and so you have to pay interest. Interest rates vary

based upon the the type of loan and the purpose of the money.

What is the average rate in each category?

a.) Car

loan

b.) Student

loan

c.) House

loan

d.) Personal

loan

e.) Business

loan

f.) Credit

card rate

g.) Payday

loans (about)

4.) If you pay your credit card balance in full, then you pay

zero interest. But you can choose how much to pay.

How much interest would you pay if you had a balance of

$2,000, a 20% interest rate, and you minimum payment was

"Interest + 1% of the balance"?

5.) In what way(s) do

credit cards help or hurt people? How does using a credit

card impact how much consumers spend? (Google it).

6.) What is Dave's "Debt Snowball?" Dave acknowledges that this

isn't the best mathematically optimal solution ... why does he

teach it even though he has lots of haters?

7.) What is your

plan for credit cards and why?

Discussion Seminar V:

Buying a house

Overview: Buying a house doesn't make you

better or happier. But we all need a place to live and

many folks want to own a home. If this is you, I want to

help it be a blessing and not a nightmare.

Instructions: Learn a little of what Dave says about buying a

home. Here are a few videos; pick what is helpful to you:

A college

student asks about how to buy a first house.

Is rent a

waste?

What if

I'm not paid enough? and the

Best way

to buy a house. Then answer the discussion questions below in writing. Include

the questions on your document and bring a physical (paper) copy

to class.

0.) What is your name? Suppose you

were to have a child, would you consider naming your child after

yourself? Why or why not. (I'm Dusty IV and my son

is Dustin V. It's kinda a family thing.)

1.) Do you believe it is possible for a Gen Z first gen student

at Highline to someday own their own home? Why or why not?

2.) What is the average

cost of a house in Des Moines, WA?

(Note: Feel free to change the details to fit your situation).

3.)

The average

down payment for

first time home buyers is about 6%. How much do you need to

save for a down payment? (Note: For the sake of simplicity, we

are ignoring loan origination fees)

4.) If you make the down payment in (3.), how big a mortgage

(aka loan) will you need to purchase the house? Use the TVM

solver on your calculator.

5.)

What monthly payment can you expect to pay for the house?

Assume a 15 year fixed rate mortgage at the

average house

mortgage

rate. (Note: For the sake of simplicity, we are

ignoring taxes and insurance)

6.) How much (down payment + monthly payments) will you pay for

the house over the life of the loan? How much interest will you

pay?

7.) Traditionally, you shouldn't

spend more than 25% of

your income on a mortgage. How much would you need to make a

month (and year) to be able to afford this house?

8.) How much does a Software

Developer make?

Could they afford this house? What if they saved up a 20% down

payment? What if the house was $100,000 cheaper? What if

interest rates were 4%?

9.) What are other ideas you have

for making a home purchase affordable for you? (Type of

property, who lives there, location, size, ...)

10.)

What is your plan for having/finding a place to live? What

is your timeline?

Discussion Seminar

VI:

Saving for the future

Overview: Many of us may (one day) hope

to retire. This isn't a moral right or good and wasn't

even possible until relatively recently. But it is a

common goal in America. However, most American's are not

on track to achieve this with the median retirement savings of

retirement age Americans at about $200,000 (Nerdwallet

article).

We don't know the future and so even the

best plan could fall through. However we know that

retirement (likely) won't be possible unless we have a plan.

This lesson teaches a very simple plan that (all things being

equal), should allow you to retire.

Instructions:

Dave says that we pay off our debts then build our emergency

fund, and only then do we begin to save for retirement (although

sometimes it is required through our jobs). Once you get

to this point, you gotta figure out how to invest. Learn a

little of what Dave says about investing. Here are a few

videos from Dave; pick what is helpful to you:

Right way

to invest 15%.

What to

invest in?

Dave to

Gen Z and

which

funds take two?

0.) What is your name? Would you rather that no-one knew your

name or that everyone knew you because of something embarrassing

that you had done? Why?

1.)

What is the average return of the stock market over the last 30

years? (Ask Google)

2.) What salary do you expect to

earn after graduation?

3.) Using a TVM solver, if you saved 15% of your income (post

graduation) in mutual funds earning 8% interest beginning at age

24. How much will you have when you retire 41 years later at

age 65? How much total money will you have saved? How much

interest will you have earned?

4.)

Suppose you retire with that amount (PV) invested at 8% and then

withdraw an equal amount each month for the next 25 years until

you have $0 (FV) left. How much should you withdraw each

month? How much total did you withdraw? How much interest will

you have earned?

5.) These results in (3.) and (4.) were possible in part because

they assumed an 8% interest rate. Is it reasonable to predict

an 8% return? Why or why not.

5.)

I believe that all things being equal (no war, cancer, or zombie

apocalypse), every student in this class can be a millionaire

and retire (should you choose to do so). What do you

believe and what is your goal for getting there?

6.) Suppose

you make a bunch of solid financial decisions over a long period

of time. The chances are that you will end up pretty

wealthy. This would be a blessing. What (if any)

plan or goals do you have for blessing others through giving as

you will have been blessed?

Discussion Seminar

VII:

Letter to a Future Student

Overview:

This week you have a chance to reflect, direct, and encourage a

future student.

Instructions:

Please write a 1+ page letter to my future students.

Include the parts listed below, but you do NOT need to include

these headings ... I mean, this is supposed to be a letter so

make it look like one:-).

1.) Introduce yourself, what you are majoring in, and a bit

about your background.

2.) What were some of the challenges

you faced this quarter (personally or as a student) and how did

you make it through?

3.) What advice do you have for being

successful in a class taught by Dusty?

4.) What are the good parts of the flipped

class model? What made it challenging for you?

5.) Please end your

letter with something to encourage the reader.