216 Amortization Project

Amortized loan:

i. An

amortized loan is a loan that requires interest payments to be made

periodically. The period is typically one month for a home loan. When an

individual makes the monthly payment, part of the payment is interest and part

of the payment is a reduction in the loan amount.

Interest:

ii. Interest

is like rent on money

iii. If

the borrower agrees to pay an annual interest rate of 12%, the monthly interest

rate would be 6%/12months = .5% per month.

iv. If

the current monthly balance of the loan is $250,000, the interest calculation =

*

$250,000*.5% = $1,250

v. If

your monthly payment sent to the banker (creditor) = $1,348.99, then the two

parts are:

*

$1,250 = Interest paid to Banker

*

$1,348.99 - $1,250 = $223.99 left over to reduce

your current loan balance

vi. After

the banker received your payment of $1,348.99, your current balance for your loan

would =

*

$250,000 - $223.99= $224,776.01

Amortization tables:

i. An

amortization table shows what part of a monthly loan payment (PMT) goes into

the banker’s pocket as interest and what part is applied to the principal loan

amount (Current Balance of Loan) for every payment.

Directions

for creating the 216 Amortization

Project

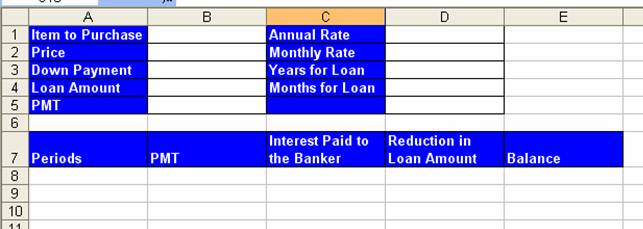

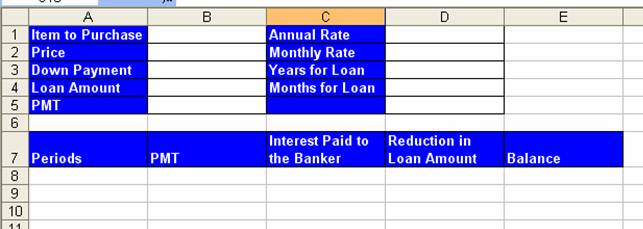

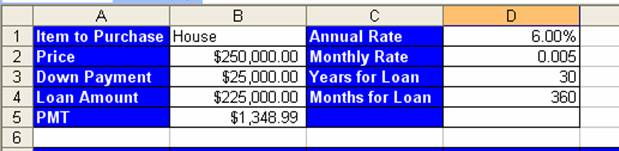

1)

Looking at the picture below, type the text, add color

to the cells and text, add borders, add word wrap to row 7, and resize the

columns so that the text is easy to read

2)

Name the sheet tab “Bank Loan for House (1)”

3)

Save the workbook with the name: “Amortization Table”

4)

Add the following page set up elements:

i. Margins

Tab: center on the page horizontally

ii. Header/Footer

Tab:

*

Custom header:

i.

Left section: file name

ii. Center

section: sheet tab name

iii. Right

section: date

*

Custom footer:

i.

Center section: “Page 1 of ?”

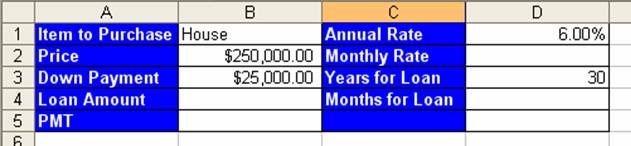

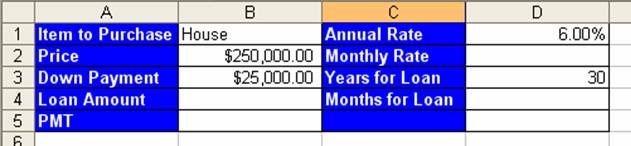

5)

Add the following data:

6)

In cell A8 type the number 0

7)

Create a formula in cell A9 that is “one above plus 1”

8)

Copy the formula in A9 to the range A9:A368

9)

Highlight the range A7:E368 and then click the “All

Borders” button on the Formatting Toolbar

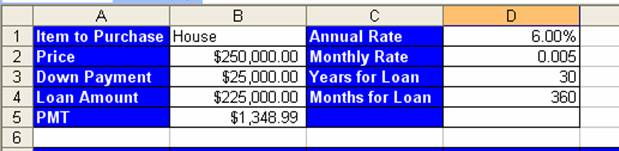

10) Create

the appropriate formulas in cells B4, B5, D2, D4 so that the assumption table

looks like this:

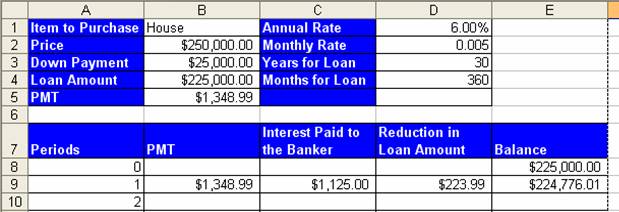

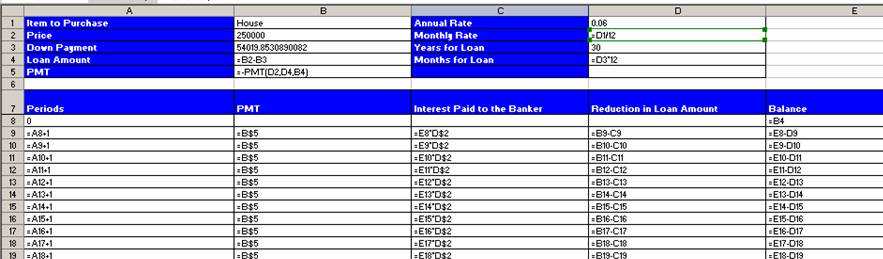

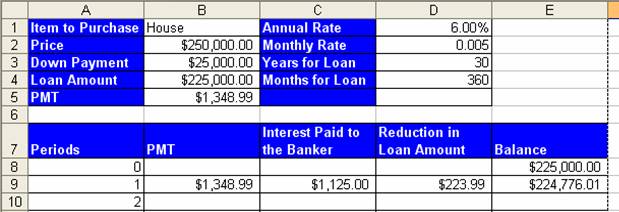

11) Create

the Appropriate formulas (with mixed cell references) in the cells E8, B9, C9,

D9, E9 so that the zero period and first period lines look like this:

12) Copy

the formulas in cells B9, C9, D9, E9 down to row 368 by highlighting the range,

pointing to the fill handle, and double clicking the fill handle with the

“angry rabbit”

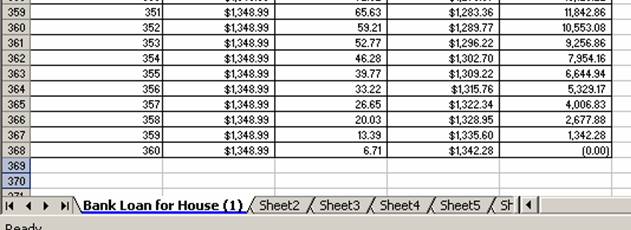

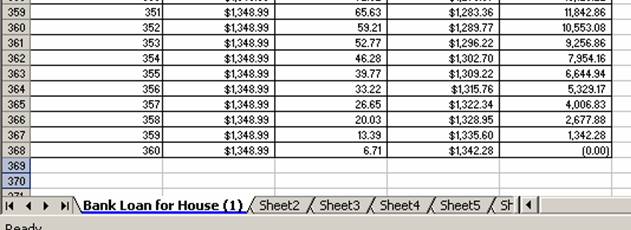

13) Look

at the bottom of the table to verify that the formulas are correct. Then fix

the apparent “negative zero.”

14) Wow!

Finance is Fun!